Small business holders get various benefits with the QuickBooks Online Bill Pay Service feature, such as: What if the user is already having a account:įeature and Benefits of QuickBooks Online Bill Pay Service.Authorization to others given by user i.e accountant and bookkeeper:.All applicable charges are done through QuickBooks Online Bill Pay Application:.

#PAYING BILLS IN QUICKBOOKS HOW TO#

How To Pay Bills, Remove Payments & Manage Bills.How QuickBooks Online Bill Payment Service Works.Feature and Benefits of QuickBooks Online Bill Pay Service.Bank transfer- $0.49 per transaction and Paper check- $1.49 per transaction. Also, some additional charges fees apply i.e. You have to pay a $9.99 monthly charge directly from for the Bill Pay account.

#PAYING BILLS IN QUICKBOOKS TRIAL#

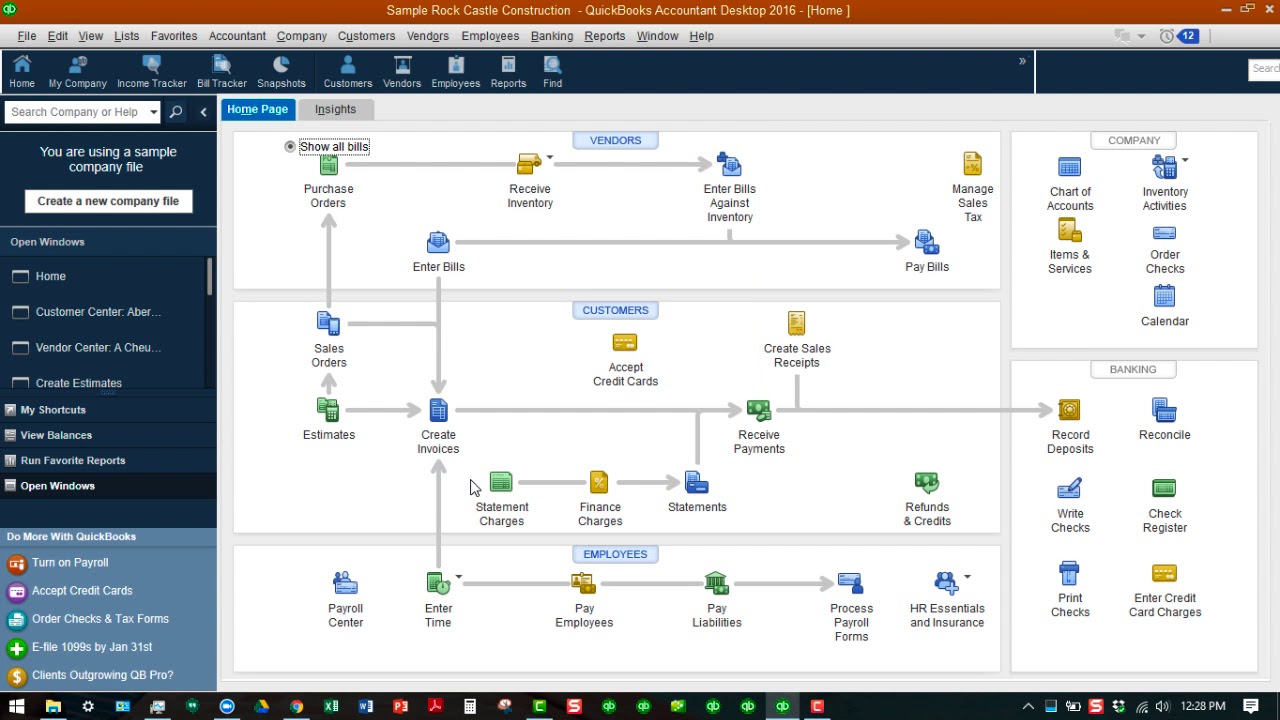

If in case, you want to trial paying a bill using QuickBooks Desktop then download the QuickBooks trial version. There are lots of advanced features available in this solution like you can track the payment, knowing information when your vendor or client gets it. Currently, It is a leading Bill payment solution. So, go through the article to learn the online bill pay, if you face any difficulty in doing so then contact QuickBooks payment support through the toll-free +1-84.īill.com is a trusted Intuit partner. In this article we will explain to you its benefits, how does it work, and how to use it to pay bills via bank transfer or check directly from QBO. It is an effective and easy way to pay bills and make payments right from within QuickBooks Online. Please refer to the onscreen Help for instructions.Recently QuickBooks Online and announced a most awaiting feature – Online Bill Pay. (Note: You can also create online payment instructions in the Write Checks window, from an online account register or from other areas QuickBooks. Usually the payee takes a few days to process payments, and your financial institution needs a day or two to clear them and make the information available. When you're finished creating your online payment instructions, send them to your financial institution.Īllow a few days after the delivery date for payments to show as cleared. Enter the required PIN number and select “OK.” QuickBooks will then send your online payment instructions to your financial institution.Ĥ. Make sure each of the payment requests you want to transmit is checked and select “Send.”ģ. Choose “Online Banking” and then “Online Banking Center.”Ģ. When you're finished creating your online payment instructions, this is how to send them to your financial institution.ġ. Select “OK” to send the instructions to the Items to Send list in the Online Banking Center checkbox to include bill and credit reference numbers on the check voucher.ĥ. Select “Online Payment” for your payment method.ģ. You can change it to a later date that occurs within the next 12 months.Ģ. From the Activities menu, choose “Pay Bills.” QuickBooks enters the earliest possible Payment Delivery date by default. You can create online payment instructions in the Pay Bills window by following these easy instructions.ġ.

0 kommentar(er)

0 kommentar(er)